UBINIG

Final Report

Executive Summary

a. This study: Smokeless tobacco (SLT) use in Bangladesh is high, yet it is generally held that SLT manufacturing often occurs outside the tax net. This study examines SLT production, pricing and turnover for a sample of 88 SLT manufacturers operating outside the tax net and identifies factors perceived to contribute to non-payment of taxes by SLT manufacturers.

b. Study methodology: The study incorporated a desk review of research literature on SLT manufacturing in Bangladesh and both quantitative and qualitative data collection methods; specifically, the NBR data on SLT manufacturers and their tax payment history, a survey of 88 SLT manufacturers operating outside the tax net, 15 key informant interviews (KIIs) and a group discussion with experts on SLT taxation.

c. SLT manufacturers’ list: The desk review of prior studies on SLT manufacturing produced a list of the 435 Zarda and Gul manufacturers in Bangladesh. The NBR provided data on 218 SLT manufacturers with a consistent record of VAT payment during the five-year period from FY 2015-16 to FY 2019-20.

d. SLT taxation: SLT taxation is governed by the Value Added Tax and Supplementary Duty Act, 2012. The government introduced maximum retail price (MRP) as the tax base for SLT products replacing tariff value in FY 2019-2020. The tax structure of SLT products is characterized by low tax base and ad valorem tax system.

e. Low SLT revenue share in total tobacco tax revenue: The total revenue collected from the 218 SLT manufacturers who paid all taxes due from FY 2015-16 to FY 2019-20 is Tk. 165.75 crore. As a percentage of total tobacco tax revenue, SLT revenue is very low, from 0.11% to 0.17% from FY 2015-16 to FY 2019-20.

f. Trade license: Of the 88 SLT manufacturers surveyed, 67% have valid trade licenses.

g. Mechanization: 91% of manufacturers rely on manual production of SLT products.

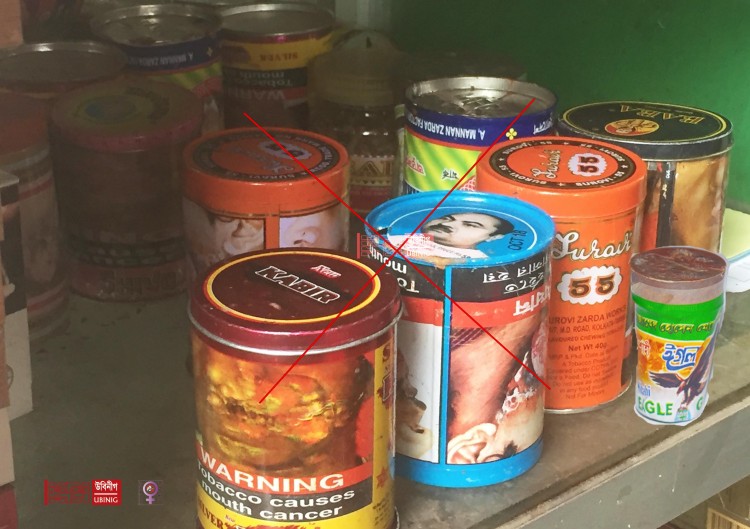

h. SLT brands: Among 81 Zarda manufacturers surveyed, 63% operate businesses producing one brand, while 37% produce 2 or more brands. The 7 Gul manufacturers produce only one brand each.

i. Weight variation of SLT brands: The SLT brands are produced in different weights. In general, SLT brands are sold at lower weights, more than a quarter are in the range of less than 10 g., and half of the SLT brands are in the range of 10 g. to 25 g.

j. Price variation: Zarda price is less than Tk. 10 in 37% brands/weights and less than Tk. 20 in 23% brands/weights. Gul price is less than Tk. 10 in 90% brands/weights and less than Tk. 20 in 10% brands/weights. The minimum price of Zarda is Tk. 3.5 for 3g and the maximum price is Tk. 1000 for 1000g at the factory level. The price for most common weight 10 g is Tk.5.

k. Gross turnover: The 88 SLT manufacturers included in the survey produce 138 SLT brands and 37 crore SLT packages, yielding an estimated gross annual turnover of Tk. 226.70 crore for 2020.

l. Implications for tax policy: Many factors contribute to the deficiencies documented in tax compliance: a lack of a comprehensive tax policy that adequately addresses concerns about public health and illicit trade; capacity constraint of the NBR field offices; gaps in the tax implementation that serve to minimize enforcement; complexities with licensing and submitting tax returns; and most importantly, loopholes that allow for the informality of the SLT sector and result in low revenue collection from the SLT manufacturers. Policy remedies are needed to address these issues.

m. Recommendations:

• Restructure the SLT tax structure to protect public health and improve revenue collection.

• Support capacity building of the NBR by restructuring its field formations with resources.

• Formalize the SLT manufacturing business through inclusion in financial systems (e.g., banking).

• Introduce banderole for monitoring.

• Bring automation to the tax return processing system.

• Authorize local government institutions to bring SLT manufacturers under local tax nets.

• Introduce a secure tracking and tracing system.

• End the practice of recognizing tobacco manufacturers with awards.

Full report pdf (11 April, 2021)