UBINIG

Investigation conducted by UBINIG (Policy Research for Development Alternative)

Smokeless Tobacco Use in Bangladesh

Smokeless tobacco (SLT) is an addictive and deadly tobacco product that causes cancers of the oral cavity, pancreas, and esophagus and, for pregnant women, increases the risk of still births and premature delivery.1,2 Bangladesh has one of the highest rates of SLT use in the world3, 20.6% of adults (22 million people) and 4.5% of students (age 13–15 years old) consume SLT.4,5 SLT is a largely informal, unregulated, and under taxed product and manufacturing sector in Bangladesh.

The UBINIG Study

UBINIG conducted a study to better understand the production, tax payments, and tax compliance of SLT manufacturers in Bangladesh. The study included a desk review of tax payments from SLT manufacturers from the National Board of Revenue (NBR) of Bangladesh, key informant interviews with 15 experts on SLT taxation, and a survey of 88 non-tax paying SLT manufacturers (81 Zarda and 7 Gul) across 53 upazilas in 29 districts of 8 divisions in Bangladesh (Fig. 1). Survey data collection was conducted August to November 2020.

Key Findings

Desk Review

- There are 435 Zarda and 48 Gul factories in the country, among these 218 Zarda and Gul factories in 32 districts are paying taxes since 2015.

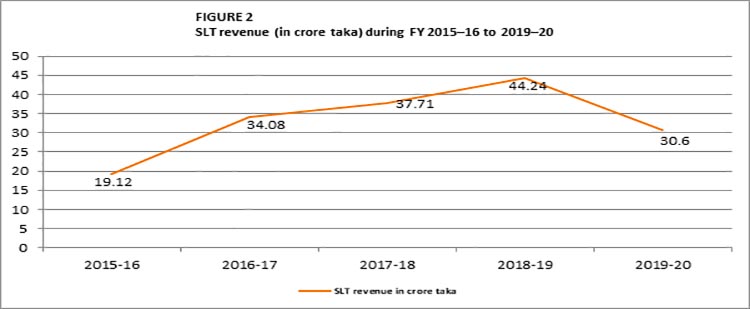

- SLT revenue collection shows an increasing trend from FY 2015–16 to FY 2018–19, but a decline in FY 2019–20 (Fig. 2).

- The total revenue collected from SLT manufacturers from FY 2015–16 to FY 2019–20 is Tk. 165.75 crore.

- SLT revenue made up between 0.11% to 0.17% of the total annual tobacco revenue from FY 2015–16 to FY 2019–2020 (Table 1).

Table 1: SLT revenue in Bangladesh (in crore Taka) during 2015-16 to 2019-20

| FY | SLT revenue | Tobacco revenue | SLT revenue % of total tobacco revenue |

| 2015-16 | 19.12 | 16713.86 | 0.11 |

| 2016-17 | 34.08 | 20013.94 | 0.17 |

| 2017-18 | 37.71 | 22866.91 | 0.16 |

| 2018-19 | 44.24 | 28551.55 | 0.15 |

| 2019-20 | 30.60 | 26388.10 | 0.12 |

Source: NBR, 2020

Key Informant Interviews

- Tax administration and compliance is hindered by the informality of the SLT sector, a lack of trained NBR officials, the organizational structure of NBR field offices, and the NBR’s outdated equipment and systems.

- The absence of a fully digitalized and automated tax return processing system and the lack of a secure track and trace system facilitate tax evasion.

- SLT revenue collection is not prioritized as tax officers can meet revenue targets more easily through cigarette tax collection.

- Lobbying by tobacco companies impedes efforts to strengthen tax administration and enforcement. Furthermore, the government periodically awards SLT manufacturers which sends conflicting signals about the government’s commitment to public health and its tobacco control policies.

SLT Manufacturer Survey

- 33% of SLT manufacturers did not have valid trade licenses.

- SLT is manufactured primarily in small un-marked factories or houses.

- 91% percent manufacturers produce SLT products manually.

- The total monthly gross turnover was estimated at Tk. 2.7 crore.

Recommendations

This study finds that the government has failed to collect needed revenue from SLT manufacturers, thereby depriving itself of funds to improve the public health of Bangladesh. Based on the findings of this investigation, UBINIG recommends the following:

- Reform the SLT tax structure to protect public health and increase revenue. The current tax structure should be strengthened to narrow the price gap between smokless products (Zarda and Gul) and make SLT less affordable.

- Automate the tax return processing system to help identify fraudulent tax returns and improve tax compliance.

- Invest in capacity-building and restructure NBR field formations. More resources are needed to train personnel and upgrade technology so that the unregulated SLT manufacturers can be identified and brought under the tax net.

- Formalize the financial transactions of SLT manufacturing sector. Financial transactions made through banks provide a monitoring mechanism that makes tax evasion more difficult.

- Introduce a secure tracking and tracing system (TTS) that includes a banderole. A secure TTS that is independent of the tobacco industry can help improve tax compliance by identifying and removing illicit products from the supply chain.

- Authorize local government institutions to bring SLT manufacturers under local tax nets.

- End the practice of recognizing tobacco manufacturers with awards given their production of a product that is very dangerous to health.

REFERENCES

- World Health Organization. IARC Monographs on the Evaluation of Carcinogenic Risks to Humans. Volume 89: Smokeless Tobacco and Some Tobacco-Specific N-Nitrosamines. Lyon (France): World Health Organization, International Agency for Research on Cancer. 2007.

- U.S. Department of Health and Human Services.The Health Consequences of Smoking—50 Years of Progress: A Report of the Surgeon General. Atlanta: U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health. 2014.

- Siddiqi, K., Husain, S., Vidyasagaran, A. et al. Global burden of disease due to smokeless tobacco consumption in adults: an updated analysis of data from 127 countries. BMC Med 18, 222 (2020). https://doi.org/10.1186/s12916-020-01677-9

- World Health Organization. Global Adult Tobacco Survey 2017, Bangladesh.

- World Health Organization. Global Youth Tobacco Survey 2013, Bangladesh.